Friday, December 31, 2010

2010 FX Review

Thursday, December 30, 2010

Daily DXY Roundup - 12/30

The British Pound was the broad loser on the day following weak UK housing data. The Sterling exchange-rate index fell to a fresh 2-month low as the GBP/USD retreated back towards the lower end of its recent range and the GBP/CHF reached a new lifetime low. Oversold daily studies and thin trading conditions should allow for temporary consolidation as the immediate focus shifts to more UK housing data on Friday.

The Swiss Franc continues to be an outperformer, benefiting from its safe-haven status. The trade-weighted index finished up 0.66% following fresh all-time highs vs. the euro, dollar and pound. Further upside, however, should be hampered by thin holiday trade and oversold daily studies.

The USD/JPY managed to find a foothold at 81.36, the 76.4% retracement of the 80.23/84.51 advance on the back of bullish diverging hourly studies. Oversold daily conditions also contributed to the pairs bounce, forming a daily spinning top base. Dollar bulls will now need to reclaim the former swing low at 82.34 to avoid a re-test of November’s cyclical low at 80.23.

Wednesday, December 29, 2010

Daily DXY Roundup - 12/29

The US Dollar Index (DXY) continues to struggle to clear the 130-day moving average, losing nearly one percent after rejecting near this key resistance overnight. As a result, dollar bears were redirected towards newly formed platform support at 79.58, leaving a downside breach of daily (9-period) RSI trendline support. Further weakness will expose 78.82/79.22, between the December 14th swing low and the key 38.2% retracement. Overcoming downward sloping trendline resistance near 80.20 is now necessary to regain the medium-term bullish tone.

The Japanese Yen was the broad winner on the day, increasing 0.70% vs. a trade-weighted basket of currencies. The GBP/JPY marked a fresh 2-year low, but managed to recover following a weak test of Tuesday's fresh low. The USD/JPY failed to regain the 50-day moving average and saw follow-through selling pressure following a bid in the treasury market. Oversold daily studies and possible bullish hourly diverging studies hint of possible consolidation going into thin end-of-year trade. Meanwhile, the yen exchange-rated index (Bloomberg: CEERJN:IND) continues to ascend towards the late October all-time high.

The AUD/USD re-tested the November peak, marking a fresh year-to-date high. Due to the recent outperformance, the Aussie now looks overvalued at current levels according to daily overbought readings vs. a variety of currencies. The Australian currency, however, is expected to outperform in the new year given robust risk appetite in global equity markets and should be accumulated on any oversold dips.

Tuesday, December 28, 2010

Daily DXY Roundup - 12/28

The US Dollar Index (DXY) managed to recover earlier losses in overall thin trading conditions. Bullish hourly diverging studies (MACD & RSI) triggered a rebound just above the December 17th low in the mid-79 region. Not only does this potentially mark platform support, but it also represents a failure to break daily (9-period) RSI trendline support. A daily close above the resistant 130-day moving average at 80.48 is now required to confirm an upside break-out towards the 200-day moving average. Meanwhile, only a daily close below the 30-day exponential moving average will shift focus back to the Fibonacci retracement at 79.223.

The EUR/USD was the underperformer on the day after rejecting at the 25-day exponential moving average. Bearish hourly diverging studies also triggered a failure to clear the daily (9-period) downward sloping trendline. Moreover, price-action has confirmed a bearish daily spinning top formation that now refocuses euro bears back to the key 1.3080 region. A break below this important 50% retracement level would then suggest a re-test of the 1.2970 swing low. In the meantime, only above RSI trendline resistance and the 25-day exponential moving average (now at 1.3264) will shift expectations higher.

The Swiss Franc continues to be an outperformer, trading up nearly a percent against a trade-weighted basket of currencies. The Swiss currency reached fresh all-time highs vs. the US Dollar and British Pound, while continuing to hover above last week’s all-time high vs. the euro. Further upside, however, could be hampered by thin holiday trade and possible daily bearish diverging studies. As such, overbought hourly technical indications seem to be a more appropriate strategy to short the EUR/CHF, GBP/CHF and USD/CHF.

The British Pound finished the day relatively unchanged. In addition to marking a fresh all-time low vs. the Swiss Franc, a new cycle low was reached vs. the Australian Dollar. The GBP/USD failed to clear the 1.5484 former swing low, triggering a sharp relapse to last week’s swing low near 1.5350. Possible daily bullish diverging studies and the persistent probe of the 200-day moving average suggest that the Cable could consolidate until the bulk of traders return to the market next week.

The USD/JPY broke below the 50-day moving average and 50% retracement level at 82.45 following strong Japanese economic data and renewed selling pressure in Asian equity markets. The pair found support, however, near the 61.8% retracement at 81.86 to form a daily bullish hammer. Dollar bulls will now look to reclaim the formerly supportive 50-day moving average at 82.70 to avoid a re-test of the Fibonacci pivot at 81.86.

Monday, December 27, 2010

Daily DXY Roundup - 12/27

The EUR/USD managed to recover off 1.3080 (the key 50% retracement level) as the 2-year yield differential (vs. the US) rebounded off 3-month lows. Euro bulls will now need to pay attention to the daily (9-period) RSI downward trendline for hints of future direction. A break above RSI resistance could trigger a re-test of the 25-day exponential moving average located at 1.3274. A rejection, however, re-opens 1.3080 and potentially the 1.2970 swing low.

The British Pound continues to underperform, losing nearly half a percent on the day vs. a trade-weighted basket of currencies. The GBP/USD remains near the 200-day moving average since failing to reclaim the 1.5484 pivot. The near-term outlook is bearish while price-action remains below this former swing low. The 1.5260/1.5350 region would be the next target for Sterling bears.

Meanwhile, the GBP continues to consolidate off recent cycle lows vs. the Aussie and the Swissy. Daily RSI levels reached such oversold conditions late last week that a corrective bounce was warranted. The limited short-term recovery, however, suggests that the GBP/AUD & GBP/CHF are both vulnerable to renewed selling pressure.

The USD/JPY managed to find support at the 50-day moving average once again. Dollar bulls will now need to reclaim the 83.15 region to avoid a re-test of the 50% retracement level at 82.45. Meanwhile, Japan’s exchange rated index is dangerously close to negating a possible head & shoulders top. Exceeding 172.50 will shift focus from neckline support back to the all-time high at 173.30.

STRATEGY UPDATE:

BUY USD/JPY at 82.52, targeting 83.62 1st, risking 81.97

SELL GBP/AUD at 1.5420, targeting 1.5280 1st , risking 1.5475

SELL GBP/CHF at 1.4915, targeting 1.4680 1st , risking 1.4970

Saturday, December 25, 2010

Happy Holidays!

A breakout of the latest range requires a higher low above 80.80 or a lower top below 80.30. The downside target includes the 79.20/79.50 range, while a bullish breakout suggests a move towards the 200-day moving average.

STRATEGY UPDATE:

BUY USD/JPY at 82.52, targeting 83.62 1st, risking 81.97

LOOK TO RE-SELL EUR/CHF & GBP/CHF

Happy Holidays!

Thursday, December 23, 2010

Daily DXY Roundup - 12/23

The US Dollar Index (DXY) continues to consolidate within a tight range. Over the past few days price-action has idled between 80.30 & 80.80. A breakout of this range will require an hourly or short-term higher low above 80.80 or a lower top below 80.30. Meanwhile, the Proshares Dollar Index ETF (UUP) is favored to appreciate to the 24 level while price-action remains above 23.

.

The Swiss Franc was the broad loser on the day following profit-taking. The USD/CHF failed at the psychological .95 figure then the GBP/CHF carved out a small double bottom base, triggering a 1% correction in the trade-weighted Swissy. While oversold studies hint of further consolidation, the current correction should only last temporarily. As such, short EUR/CHF and GBP/CHF opportunities should become available early next week.

Wednesday, December 22, 2010

Daily DXY Roundup - 12/22

Tuesday, December 21, 2010

Daily DXY Roundup - 12/21

Monday, December 20, 2010

Daily DXY Roundup - 12/20

The US Dollar Index (DXY) is probing the same moving average that capped strength earlier in the month. The double bottom neckline at 80.40 has been broken and clearing 130-day moving average resistance would expose the November high. Meanwhile, only a daily close below the 20 & 100-day moving averages would compromise the bullish structure.

The Canadian Dollar was the weakest performer following weaker than expected wholesale sales data. The trade-wighted index was down over 1% on the day. The USD/CAD now looks to re-test the 100-day moving average since finding a foothold near parity. The CAD/JPY broke out of a one month rising wedge and will attempt to carve out a higher low by the 50-day moving average and 50% retracement near 81.50.

Thursday, December 16, 2010

Daily DXY Roundup - 12/16

The US Dollar Index (DXY) ended the session slightly down after rejecting at key resistance. The bullish hammer recovery paused at last week's highs at 80.40, failing to confirm a double bottom base. Bearish hourly diverging studies contributed to the bearish rejection, which now seeks a higher low to maintain the bullish structure. A sustained move below the 20 & 100-day moving averages will shift the immediate focus to the 38.2% retracement at 79.20.

The British Pound was the outperformer following an upbeat retail sales report. The GBP/USD recovered back above long-term trendline support and managed to retrace a quarter of this week's sharp decline. The pair, however, remains bearish while below the 38.% retracement at 1.5676.

The EUR/USD retested the 1.3180 region, but managed to rebound on the back of bullish diverging hourly studies. Clearing the 30-day moving average is now required to redirect bulls back towards 1.3470, a key Fibonacci retracement level.

Wednesday, December 15, 2010

Daily DXY Roundup - 12/15

The US Dollar Index (DXY) rallied on the back of rising treasury yields, confirming Tuesday's bullish hammer pattern. The next obstacle for dollar bulls is last week's highs at 80.40, above which confirms a higher double bottom base. A swing low could form near the 79.87 region, where the 20-day moving average and 100-day moving average overlap. A sustained loss of this pivot would suggest a third test of the 38.2% retracement level at the 79.20 level.

The British Pound was the weakest performer of the major currencies following a surprisingly weak employment report. The GBP/USD collapsed through its upward tilting channel then rejected near formation support. The 2-day retreat has wiped out nearly all of the gains from the previous two weeks. This bearish development suggests an imminent re-test of the November low at 1.5480. The Sterling also reached new lifetime lows against the Aussie and Swissy, as focus shifts to tomorrow's UK retail sales report.

The USD/JPY broke above the recent 84.40 ceiling to signal further strength towards 84.82/85.40 (between the 2009 former low & the September 24th spike high). Only a daily close below the formerly resistant 110-day moving average delays dollar bulls.

Tuesday, December 14, 2010

Daily DXY Roundup - 12/14

Monday, December 13, 2010

Daily DXY Roundup - 12/13

The US Dollar Index (DXY) broke out of consolidation, collapsing through triangular support. Price-action was decisively bearish, wiping out nearly all of last week's gains. The subsequent retreat probed the 38.2% retracement at 79.20 for third time. A clean loss of this key Fibonacci level exposes 78.52, the 50% retracement. Meanwhile, only a move back above the formerly supportive 20-day moving average alters the bearish outlook. The UUP (Proshares Dollar Index ETF) failed to clear key resistance to suggest a re-test of critical support at 22.

The EUR/USD reversed the recent weak downmove by breaking out of a short-term consolidation triangle. The rebound retraced nearly the entire move off the non-farm payrolls high. A higher low is now sought by the 20-day moving average for an extension towards 1.3462/1.3614 (the 38.2% & 50% retracement levels).

Friday, December 10, 2010

Daily DXY Roundup - 12/10

The US Dollar Index (DXY) continues to consolidate, forming a 3-day ascending triangle pattern. Since completing a zig-zag correction off the November low, the recent pullback has been limited to the 38.2% retracement level. While the uptrend remains intact, lackluster follow-through hints of the possibility of a bearish shift.

The greenback's rebound has stalled near the mid-way point of the previous week's relapse. More importantly, this recovery has taken nearly twice the amount of time it took to decline from the recent high. This potentially suggests the formation of a secondary high or lower top. A loss of triangular consolidation support near the 80 handle could trigger the third test of 79.22 (the 38.2% retracement). In the event of a confirmed lower high, a relapse to the 50% retracement level at 78.39 would then be favored .

An uptrend is considered to be intact while price-action remains above the 38.% retracement of the overall upmove. Thus, a move above triangular resistance at 80.40 would reinforce the bullish structure. A short-term swing low above the 80.40 pivot could then expose the important 200-day moving average.

Wednesday, December 8, 2010

Daily DXY Roundup - 12/08

The US Dollar Index (DXY) consolidated while the treasury and commodity markets continued to trade violently. The greenback's recovery off the 20-day moving average spent most of the day locked in tight range between the 38.2% and 50% retracement levels. Future direction will now require the formation of a swing low above the 50% retracement or a swing high below the noted range. A bearish breakout will reopen the key Fibonacci retracement at 79.22, which has been tested twice so far. In the event of an upside breakout, the 61.8% retracement is targeted ahead of the 200-day moving average.

Tuesday, December 7, 2010

Daily DXY Roundup - 12/07

The US Dollar Index (DXY) maintained support at the 38.2% retracement for the third straight day. This bullish development along with the sell-off in commodities should redirect dollar bulls back above the key 80 handle. The dramatic rise in treasury yields should also narrow yield differentials in favor of the US. This would also set the table for further gains through the pyschological 80 level towards 80.25/80.53. Clearing this would greatly increase the prospects for a move to the important 81.85/82.00 area. Meanwhile, only a loss of 79.22 (the 38.2% retracement) alters the bullish scenario.

...

The EUR/USD failed to overcome 20-day moving average resistance once again. The pair retreated late in the North American session to retest the key 38.2% retracement (of recent gains). Losing 1.3260 immediately shifts focus to the 1.3150/1.3210 region, while only a clean break above the 20-day moving average offers relief.

...

The USD/JPY has benefited from a rising yield environment. The pair tested 50-day moving average support before retracing 61.8% of recent losses. Dollar bulls should anticipate a retest of the 110-day moving average above the 84 handle. Clearing this key resistance immediately exposes the 84.88/85.00 region.

...

STRATEGY BUY USD/JPY at 83.40, targeting 84.88, stop at 82.85

..............SELL EUR/USD at 1.3286, targeting 1.3150, stop at 1.3341

Monday, December 6, 2010

Daily DXY Roundup - 12/06

Friday, December 3, 2010

Daily DXY Roundup: 12/03

Thursday, December 2, 2010

Daily DXY Roundup: 12/2

The US Dollar Index (DXY) has retraced a quarter of recent gains. A daily close below 100-day moving average support exposes the 38.2% retracement at 79.240. While the presence of three hourly lower tops suggests further corrective weakness, reclaiming the latest intraday high at 81.020 could stabilize selling pressure. Focus now shifts to tomorrow's employment reports out of Canada and the United States. A better than expected non-farm payrolls number could trigger further narrowing of yield differentials, which could stand to benefit the greenback.

The EUR/USD continues to benefit from reduced risk aversion. An hourly inverse Head & Shoulders formation has been completed, projecting strength to the 38.2% retracement near the 1.33 handle. Only a loss of former neckline resistance at 1.3150 softens the outlook.

Wednesday, December 1, 2010

Daily DXY Roundup - 12/1

Tuesday, November 30, 2010

Daily DXY Roundup - 11/30

Monday, November 29, 2010

Daily DXY Roundup: 11/29

Continued risk aversion has benefited the greenback, triggering a 2-month high for the DXY (US Dollar Index). The October/November double bottom measured move has been exceeded to suggest a possible extension to the 82 region. This key level coincides with the 200-day moving average, the 78.6% retracement and an equality target. Meanwhile, only a move below 79.461 (the November 16th swing high) would alter the short-term bullish wave count.

The EUR/USD is at a key inflection point. A sustained loss of the key 50% retracement level at 1.3075 would shift the medium-term outlook much lower. While former trendline support near the 1.33 handle continues to cap, a move towards the equality target at 1.2940 is favored.

The Cable's (GBP/USD) intra-day bearish rejection at 1.5652 (the October low) has maintained the immediate bearish structure. The 200-day moving average is next targeted while price-action remains capped by the key 1.5652 pivot.

Friday, November 26, 2010

Daily DXY Roundup: 11/26

Tuesday, November 23, 2010

STRATEGY UPDATE:

STRATEGY: BUY AUD/USD at .9780, risking .9725, targeting .9825 1st

Daily DXY Roundup: 11/23

Monday, November 22, 2010

Daily DXY Roundup: 11/22

Saturday, November 20, 2010

Dollar Direction Dependent on UUP

On Monday, the Powershares US Dollar Index ETF (UUP) celebrates its 4-year anniversary. Despite its short existence, the UUP has provided a clear-cut way to play the greenback. In both cases when the UUP clears the 23 level, the US Dollar Index tends to breakout to the upside.

Following the Bear Sterns collapse, the UUP was in the process of forming a base at the 22 level. In the ensuing months, price-action held within a tight range between 22 and 23 up until the Lehman bankruptcy. As a result of the panic selling in September 2008, the UUP managed to clear the key 23 level. This triggered a dramatic recovery that climaxed at all-time highs.

Just over a year later, the UUP was back down to the 22 handle. Once again this key level provided support. However, this time it was risk aversion inspired by the fallout of Dubai's debt problems that allowed the US Dollar to carve out a bottom. After briefly respecting the 23 level as resistance, the subsequent clearance led to a powerful 10% rebound.

The US Dollar Index eventually reached a peak back in June. This coincided with the finalization of a comprehensive rescue package that ensured financial stability across Europe. The introduction of additional quantitative easing by the Federal Reserve provided a further drag on the dollar, triggering the latest test of the 22 region.

Recent euro weakness, stemming from Irish sovereign debt concerns has allowed the UUP to recover from the 22 region. This has enabled the dollar to bump up against key resistance. While Tuesday's rejection at 23 maintains the ongoing bearish structure, history suggests that while 22 remains supportive, the UUP should be accumulated.

If the 23 level is sustainably broken, then the US Dollar should appreciate significantly. In the previous two occasions, initial strength reached the 24 level before eventually targeting the 26/27 area. If 23 continues to cap, however, then the dollar's recovery could be in jeopardy. A move below 22 support would translate into uncharted territory for the UUP.

Friday, November 19, 2010

Daily DXY Roundup: 11/19

The US Dollar Index (DXY) continues to respect the 50-day moving average on a closing basis. Bullish diverging hourly studies triggered a rebound off the European lows that eventually rejected at 50-hour moving average resistance. This potentially jeopardizes the near-term bullish structure and could signal a test of the 38.2% retracement level at the 78 handle. Meanwhile, clearing the key 50-hour moving average would increase the probability of confirming a higher low. .

The USD/CHF has garnered attention with the latest back-to-back bearish rejections at the psychological parity threshold. This pair is now favored to test the 100-day moving average while price-action remains above .9900 on a (daily) closing basis.

The EUR/USD’s recovery fell short of the key Fibonacci retracement at 1.3760, capping gains at the 200-hour moving average. The short-term double bottom recovery remains relatively firm, given its distance above the 100-hour moving average. Clearing 200-hour moving average resistance should trigger a test of the targeted 1.3760 level.

The GBP/USD rejected near the 50% retracement at 1.6068 on the back of bearish diverging hourly studies. The subsequent retreat managed to maintain support just above the 61.8% retracement near the end of European trade. A decisive loss of this Fibonacci level could put 50-day moving average support in jeopardy.

The AUD/USD has formed an inverse Head & Shoulders base with the latest dip. A clean upside break of neckline resistance in the .9900 region would be an attractive (long entry point).

Thursday, November 18, 2010

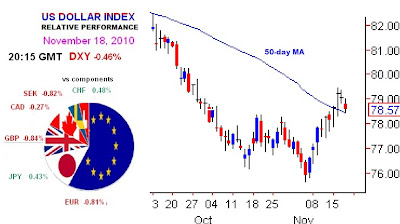

Daily DXY Roundup: 11/18

The EUR/USD extended Wednesday’s double bottom recovery before stalling at the 50-day moving average. Only a loss of the formerly resistant 100-hour moving average would shift focus away from 1.3760 (Fibonacci retracement).

The USD/JPY remains well-bid ahead of the 50-day moving average. While price-action stalled at 83.76 (the 61.8% retracement) continued strength towards the upper 84 region is favored.

The GBP/USD continues to respect 50-day moving average support. The latest rebound has recovered more than 38.2% of the recent weakness, suggesting further strength through 1.6068 (the 50% retracement).

The S&P 500 rebounded from the correction target of 1175/1180 on the back of oversold daily conditions. Reclaiming the 14-day moving average at 1203 is now required to shift the near-term focus higher.

Wednesday, November 17, 2010

Daily DXY Roundup: 11/17

The US Dollar Index (DXY) consolidated recent gains in an otherwise non-eventful day. Overbought daily conditions along with bearish diverging hourly studies triggered a slight pullback that has marked a daily harami (inside day). While this suggests that dollar bulls have taken a breather, only a sustained loss of 50-hour moving average support would indicate that a deeper correction is in store. This would likely imply a retest of the double bottom neckline and the key 50-day moving average above the 78 region. Meanwhile, the next upside hurdle comes in the form of the 50% retracement at 79.587.

The EUR/USD found support near the 50% retracement zone off the August lows. Oversold conditions and bullish diverging hourly studies triggered a small 2-day double bottom base. This hints of a possible re-test of the 100-hour moving average, which has capped rallies over the past few days. Further strength would then target the mid 1.36 region, where several key retracement levels overlap. Meanwhile, the short-term structure is quite bearish while price-action remains capped below Friday’s swing low at 1.3575.

The USD/JPY backed off a bit, breaking (down) out of a 2-day consolidation triangle pattern in early North American trade. This has potentially left a daily tweezer top formation to hint of a near-term pullback or further consolidation. Meanwhile, while price-action remains above the previously resistant 50-day moving average, the outlook is for an upward move to the upper 84 region.

The S&P 500 has already met my correction target zone at 1175/1180 region. The current 4th wave correction is now a Fibonacci (61.8%) proportion of the previous 2nd wave correction. While oversold daily conditions could limit further weakness, reclaiming the 14-day moving average at 1200 is now required to shift the near-term focus higher.

GOLD finally lost 30-day moving average support to neutralize the medium-term outlook. Longer-term bulls should take notice of the daily (9-period) RSI. This key oscillator is now nearing oversold conditions near the 30 region, which is a level that has supported previous rebounds over the last year. Meanwhile, if the 50-day moving average fails to provide support, then focus shifts to the Fibonacci retracement at 1324