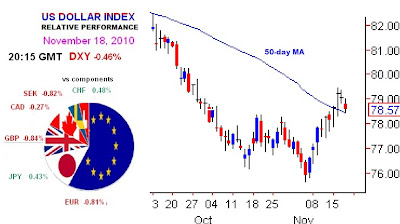

The US Dollar Index (DXY) continues to consolidate within Tuesday’s wide-ranging day. The overnight loss of 50-hour moving average support triggered a retest of the 50-day moving average. The current retreat, however, is still in corrective territory, given only a quarter of recent gains have been reversed. While dollar bulls seek higher low confirmation for a test of 79.587 (50% retracement), a daily close below 50-day moving average support would shift focus to the 78 handle.

The EUR/USD extended Wednesday’s double bottom recovery before stalling at the 50-day moving average. Only a loss of the formerly resistant 100-hour moving average would shift focus away from 1.3760 (Fibonacci retracement).

The USD/JPY remains well-bid ahead of the 50-day moving average. While price-action stalled at 83.76 (the 61.8% retracement) continued strength towards the upper 84 region is favored.

The GBP/USD continues to respect 50-day moving average support. The latest rebound has recovered more than 38.2% of the recent weakness, suggesting further strength through 1.6068 (the 50% retracement).

The S&P 500 rebounded from the correction target of 1175/1180 on the back of oversold daily conditions. Reclaiming the 14-day moving average at 1203 is now required to shift the near-term focus higher.

The EUR/USD extended Wednesday’s double bottom recovery before stalling at the 50-day moving average. Only a loss of the formerly resistant 100-hour moving average would shift focus away from 1.3760 (Fibonacci retracement).

The USD/JPY remains well-bid ahead of the 50-day moving average. While price-action stalled at 83.76 (the 61.8% retracement) continued strength towards the upper 84 region is favored.

The GBP/USD continues to respect 50-day moving average support. The latest rebound has recovered more than 38.2% of the recent weakness, suggesting further strength through 1.6068 (the 50% retracement).

The S&P 500 rebounded from the correction target of 1175/1180 on the back of oversold daily conditions. Reclaiming the 14-day moving average at 1203 is now required to shift the near-term focus higher.