On Monday, the

Powershares US Dollar Index

ETF (

UUP) celebrates its 4-year anniversary. Despite its short existence, the

UUP has provided a clear-cut way to play the greenback. In both cases when the

UUP clears the 23 level, the US Dollar Index tends to breakout to the upside.

Following the Bear Sterns collapse, the

UUP was in the process of forming a base at the 22 level. In the ensuing months, price-action held within a tight range between 22 and 23 up until the Lehman bankruptcy. As a result of the panic selling in September 2008, the

UUP managed to clear the key 23 level. This triggered a dramatic recovery that climaxed at all-time highs.

Just over a year later, the

UUP was back down to the 22 handle. Once again this key level provided support. However, this time it was risk aversion inspired by the fallout of Dubai's debt problems that allowed the US Dollar to carve out a bottom. After briefly respecting the 23 level as resistance, the subsequent clearance led to a powerful 10% rebound.

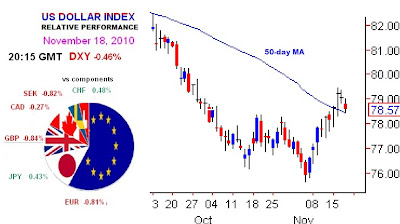

The US Dollar Index eventually reached a peak back in June. This coincided with the finalization of a comprehensive rescue package that ensured financial stability across Europe. The introduction of additional quantitative easing by the Federal Reserve provided a further drag on the dollar, triggering the latest test of the 22 region.

Recent euro weakness, stemming from Irish sovereign debt concerns has allowed the

UUP to recover from the 22 region. This has enabled the dollar to bump up against key resistance. While Tuesday's rejection at 23 maintains the ongoing bearish structure, history suggests that while 22 remains supportive, the

UUP should be accumulated.

If the 23 level is sustainably broken, then the US Dollar should appreciate significantly. In the previous two occasions, initial strength reached the 24 level before eventually targeting the 26/27 area. If 23 continues to cap, however, then the dollar's recovery could be in jeopardy. A move below 22 support would translate into uncharted territory for the

UUP.